What is Credit Card Processing?

Credit card processing is a service through which businesses accept payments from their customers through credit cards.

27% of transactions in e-commerce and in-person checkout in retail are completed via credit card payments, making it one of the most popular payment methods.

Credit card payments are a preferred contactless payment method as they enable consumers to get the most out of their bank accounts via reward points, cashback, etc.

In this article, you’ll learn how these payments work, the various fees involved in a transaction, credit card processing pricing, and how you should pick the right credit card processing and point-of-sale (POS) system.

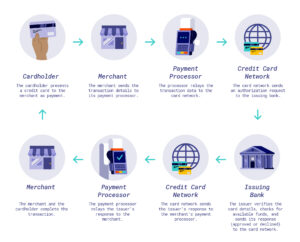

How Does Credit Card Processing Work?

Credit card transactions between the cardholder and businesses contain the following moving parts:

- Consumer: The cardholder or the customer

- Merchant: The business owners

- Payment Gateway: The mechanism which authorizes the checkout transaction during credit card processing

- Credit Card Processor: The virtual terminal, credit card reader, or payment processor which is the medium between the consumer and the merchant

- Card Network: It is a system that enables and facilitates credit card payments during e-commerce transactions

- Issuing Bank: The bank of the cardholder

- Acquiring Bank: The bank with the merchant account

The credit card payment processing is shown in the image below:

(source)

Before choosing a credit card processing company, let’s understand the transaction fees during the payment processing of credit cards.

Pricing for Credit Card Processing

Credit card processing fees should be taken into consideration before choosing a credit card processing company. These are added to the bill during invoicing and are popularly known as “hidden fees”. Below are the most common types of such fees:

- Interchange fee: Also known as interchange-plus pricing, these make up most of the transaction fees. This fee is paid between banks to process payments. In the US, the interchange fees are about 2% of the total transaction amount.

- Service fee: This is charged by the business and covers customer support, transactions, and business development. The service fees charged depend on the business or service provider and the industry.

- Processing fee: It is charged by your bank for the privilege of using credit cards. Companies charge a flat rate per transaction, but it usually varies.

- PCI compliance fee: It is charged by your payment processor or virtual terminal to ensure the merchant is compliant with the PCI DSS standards.

- Chargeback fee: This credit card processing fee is charged by the bank from the merchant account while reimbursing the customer for a fraudulent transaction. Merchants can also dispute a chargeback fee which ensures small businesses aren’t taken advantage of.

The inclusion of all the above kinds of fees in the credit card pricing model decreases the profit of the merchant. As a result, small business owners prefer to offer and promote cash payment, or by passing on the processing fee to customers in exchange for their merchant services.

Choosing a Credit Card Processing Company

Credit card processors receive and validate the cardholder’s information and the transaction details to ensure the credit card transactions are secure. These processors accept the details through the virtual terminal and relay them to credit card net card networks for payment processing.

They protect the data of the consumer and transfer the accurate amount to the merchant bank.

Credit card processing companies, like MasterCard and Visa, build devices and systems to facilitate these processing services.

Choosing the right company will have the following benefits:

- Fraud protection and security: As a business owner, it is not just your responsibility to accept payments from verified sources, but also to protect your customers from financial fraud. A good payment processor will send funds to your merchant account while decreasing the risk associated with these transactions.

- Merchant services: This is about the convenience offered by their solution. For instance, the payment processing solution should allow you to offer multiple payment options to your consumers including debit cards, in-person cash payments, and mobile payments. Another factor you should consider is hidden fees and monthly fees.

- Customer support: Small businesses, for example, can find it difficult to rely on credit card processors that take a few business days to get their tickets resolved. They need cash as soon as possible to repay the overhead costs. A credit card processing company should ensure smooth cash flow through your business as per your pricing model.

Von Payments, one of the best credit card processing companies, provides all of the above to startups and established businesses across a wide range of industries.

We provide credit card transaction processing services to every business from low to high-risk non-traditional verticals. With Von Payments, you can accept payments from your customers via mobile wallets, Google Pay, Apple Pay, debit cards, credit cards, and more. You can accept credit card payments from leading providers such as Visa, MasterCard, American Express, etc. Any and all processing fees would be passed on to the customer, which is a strong benefit for merchants.

Furthermore, we will assist you through every step to give you the best merchant services by assigning a dedicated account manager.

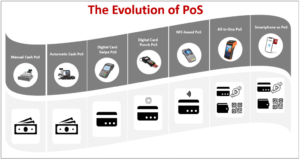

Finding the Right Point-of-Sale (POS) System

A point-of-sale system (POS system) refers to the hardware and software that accepts payments from your customers during shopping cart checkout. A common example is the cash register. However, the POS system has come a long way since.

(source)

Keep the following points in mind while choosing a POS system:

- Customer experience: It should manage and store customers’ data securely and incur minimal transaction fees. They should also be allowed to make online payments and make payments through third-party portals like Stripe.

- Adaptability: If you are accepting payments through certain means, your point-of-sale system should incorporate that seamlessly. You shouldn’t have to change how you interact with your consumers to make a payment service system work even if you are a non-traditional, high-risk business.

- Scalability: Your POS system should be able to address the growing needs of your business. For instance, introducing a mobile device to improve the in-store experience for your customers should be easy.

- Affordable: Interchange-plus pricing, monthly subscription processing fees, and taxes per transaction make many POS systems an unfriendly option for low and high-risk businesses alike. Make sure the pricing model of the POS system doesn’t drain your revenue significantly.

Now that you know what you should look for in a credit card processing company and POS system for your business, it is time to choose the right one.

Choose Von Payments for Zero Fee Payment Processing

Credit card payments are a popular method of completing e-commerce and retail transactions. The payments are authenticated through credit card networks which charge interchange fees and taxes to transfer the funds. However, these extra fees can make them undesirable for your business.

This is where you must choose the best credit card processing company which is secure, adaptive, transparent, easy to use, and scalable as per your needs.

Von Payments’ zero-fee processing platform maximizes your bottom line by passing off transaction fees incurred in processing credit cards to your customers.

Your customers can either pay by cash, which will be at a discounted rate, or by credit card where the customer has to pay the convenience fees.

Our platform is secure, takes minutes to set up and run, adaptive, scalable, and compliant with all the latest regulations in all 50 states.

Contact us today and we will get you started in no time.